PROFESSIONAL CTA FILING SERVICES

FinCEN CTA filing services for Law Firms, CPA's, Individuals, & Small Businesses

POWERED BY ORCA

Beneficial Ownership Information Reporting is Required in the US

File your BOI Report quickly and easily with our state-of-the-art software. CTA Filing Solutions provides security you can rely on, unmatched support, and solutions tailored to your needs.

What is the BOI Report?

Effective January 1, 2024, all US and foreign companies that were formed in, or have registered with any of the 50 US states, must comply with new Beneficial Ownership Information (BOI) reporting requirements with the Financial Crimes Enforcement Network (FinCEN), as prescribed by the Corporate Transparency Act (CTA).

What is the Corporate Transparency Act (CTA)?

The CTA was inconspicuously passed within the Anti-Money Laundering Act of 2020 to “better enable critical national security, intelligence, and law enforcement efforts to counter money laundering, the financing of terrorism, and other illicit activity.”

Some of our happy customers

.png?width=1879&height=1908&name=Transparent%20Logo%20(1).png)

Our Expertise

At CTA Filing Solutions, we offer a comprehensive suite of services designed to simplify your Corporate Transparency Act (CTA) filing process. Our services include easy, online filing, affordable pricing, & secured multi-year retention of data. Our team of experts is committed to providing you with the best possible service, helping you navigate the complexities of the CTA filing process with ease.

Why we stand out

Easy Online Filing

We provide an intuitive online filing system with step-by-step instructions, making the process of CTA compliance filing straightforward and hassle-free.

Affordable Pricing

Our services are competitively priced, offering a cost-effective alternative to expensive accounting or legal services. We believe that maintaining compliance should be affordable for all businesses.

Secured Multi-Year Retention of Data

We understand the importance of data security and record-keeping. Our system securely retains your data for multiple years, reducing your paperwork load and ensuring you have access to your records when you need them.

CTA Filing Solutions

CTA Filing Solutions stands as a committed ally in navigating the complexities of FinCEN registration and Corporate Transparency Act (CTA) compliance. Our services cater to both individual business owners and professional entities, with a core focus on simplifying the compliance journey to ensure it's straightforward and achievable for everyone.

CPA's

CPAs play a crucial role in managing their clients’ regulatory obligations by preparing and submitting various state and federal forms and reports. CTA Filing Solutions enhances the array of services these professionals offer, by providing a reliable software platform designed to proactively address their clients’ compliance requirements. This includes the secure collection of Beneficial Owner details and photocopies of identification documents.

Law Firms

Business leaders and key decision-makers forge invaluable partnerships with their legal representatives, entrusting them with a broad spectrum of business transactions. Law firms now extend their expertise to include compliance with the Corporate Transparency Act by preparing and filing the essential Beneficial Ownership Information report for their clientele. CTA Filing Solutions enhances the offerings of law practices through a premier software platform, designed for secure and streamlined filing processes.

Starter

$150 per filing

Individual business owners who are solely responsible for making decisions for their business. Includes one BOI filing for One Beneficial Owner.

-

Personal Dashboard

-

1 Beneficial Ownership Information (BOI) Report filed for 1 Beneficial Owner

-

Chat and email support

-

Digital Copy for your Records

-

Certificate of Filing

Professional

$250 per filing

All of the same benefits that come with the starter package and an additional BOI report filing. Ideal for businesses with two beneficial owners.

-

Personal Dashboard

-

2 Beneficial Ownership Information (BOI) Reports Filed for 2 Beneficial Owners

-

Chat and email support

-

Digital Copy for your Records

-

Certificate of Filing

Premier

$300 per year

For businesses with multiple beneficial owners or multiple individuals with decision-making power. Ideal for businesses that may have complex filings.

-

Enhanced Dashboard

-

Unlimited BOI Filings for One Business

-

Digital Copy for your Records

-

Certificate of Filing

-

Automated Reminders

-

Multi-Entity Discount

What is beneficial ownership information?

Beneficial ownership information refers to identifying information about the individuals who directly or indirectly own or control a company.

Why do companies have to report beneficial ownership information to the U.S Department of the Treasury?

- Very few U.S. states or territories require companies to disclose information about their beneficial owners—the individuals who own or control companies. This lack of transparency allows criminals, corrupt officials, and other bad actors to hide their identities and launder illicit funds through the United States using shell and front companies. This in turn hurts ordinary Americans because the lack of transparency results in an uneven playing field for honest and legitimate U.S. businesses. The inaccessibility of beneficial ownership information also makes it hard for law enforcement to track and prosecute criminal activity.

- In 2021, Congress, with bipartisan support, enacted the Corporate Transparency Act to address this problem. The Corporate Transparency Act requires certain types of U.S. and foreign entities to report information about their beneficial owners to the Treasury Department’s Financial Crimes Enforcement Network, commonly known as FinCEN. FinCEN is responsible for safeguarding the U.S. financial system from illicit use. Subject to strict safeguards and controls, FinCEN will disclose the reported beneficial ownership information to certain authorized government authorities, financial institutions, and other authorized users.

- By collecting beneficial ownership information and sharing it with law enforcement, financial institutions, and other authorized users, FinCEN is making it harder for bad actors to hide or benefit from their ill-gotten gains. Companies that report beneficial ownership information will contribute to this important goal.

When will FinCEN accept beneficial ownership information reports?

FinCEN will begin accepting beneficial ownership information reports on January 1, 2024.

What companies will be required to report beneficial ownership information to FinCEN?

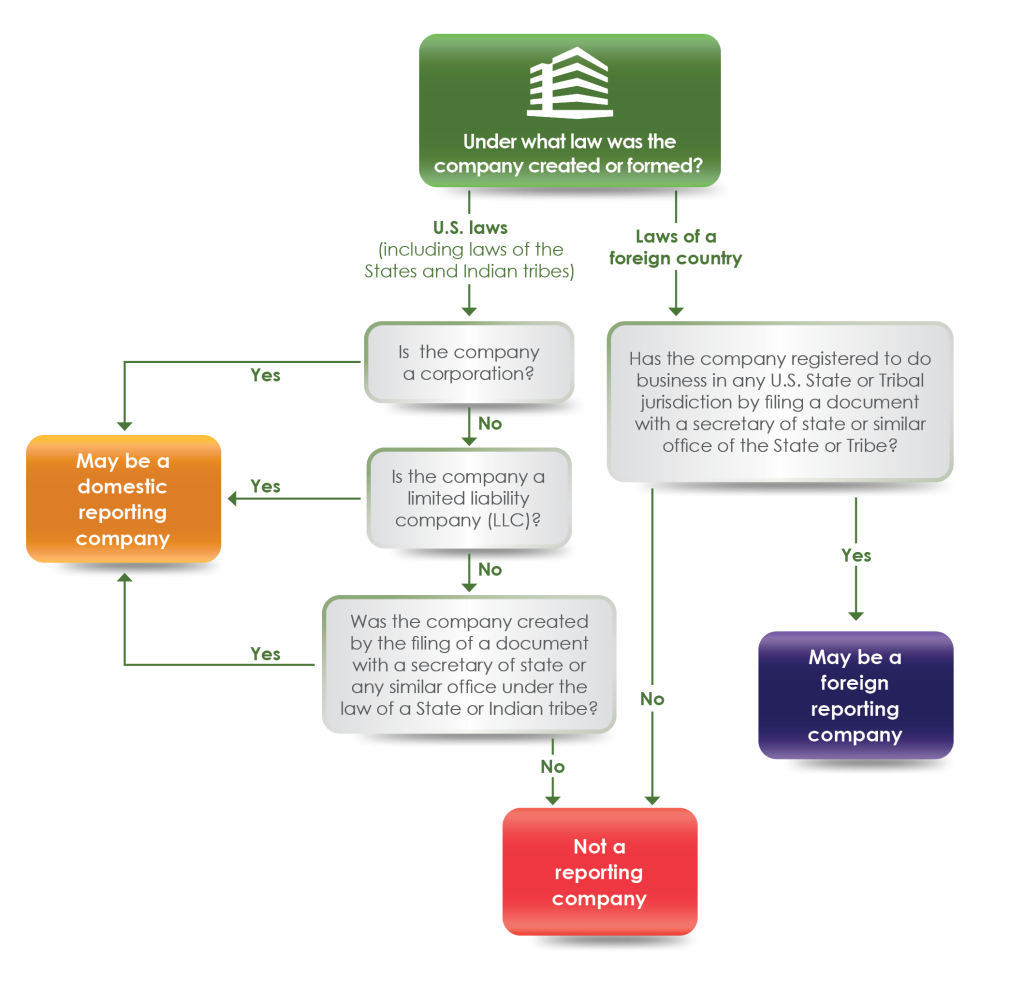

- Certain companies — referred to as “reporting companies” — will be required to report their beneficial ownership information to FinCEN. There are two types of reporting companies — domestic reporting companies and foreign reporting companies.

- A domestic reporting company is defined as —

- a corporation,

- a limited liability company, or

- any other entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.

- A foreign reporting company is any entity that is —

-

- a corporation, limited liability company, or other entity formed under the law of a foreign country, AND

- registered to do business in any U.S. state or in any Tribal jurisdiction, by the filing of a document with a secretary of state or any similar office under the law of a U.S. state or Indian tribe.

- If you had to file a document with a state or Indian Tribal-level office such as a secretary of state to create your company, or to register it to do business if it is a foreign company, then your company is a reporting company, unless an exemption applies.

- For the definitions of both domestic and foreign reporting companies, a “state” means any state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Commonwealth of the Northern Mariana Islands, American Samoa, Guam, the U.S. Virgin Islands, and any other commonwealth, territory, or possession of the United States.

-

Who is a beneficial owner of a reporting company?

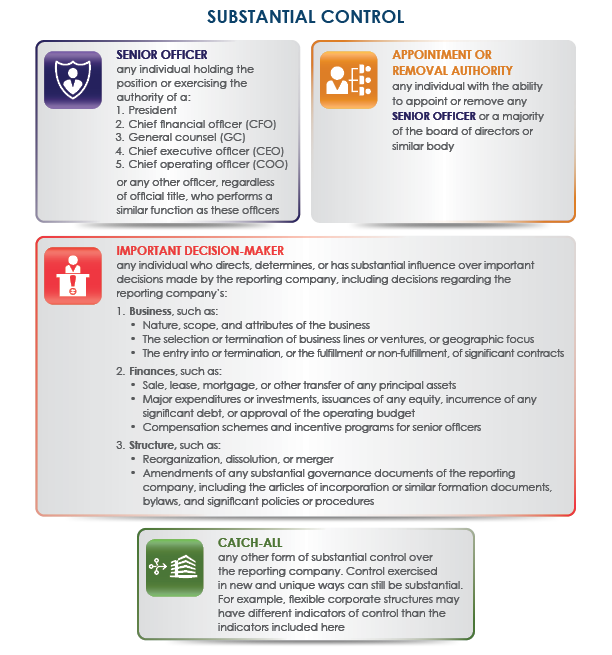

- In general, a beneficial owner is any individual (1) who directly or indirectly exercises “substantial control” over the reporting company, or (2) who directly or indirectly owns or controls 25 percent or more of the “ownership interests” of the reporting company.

- Whether an individual has “substantial control” over a reporting company depends on the power they may exercise over a reporting company. For example, an individual will have substantial control of a reporting company if they direct, determine, or exercise substantial influence over, important decisions the reporting company makes. In addition, any senior officer is deemed to have substantial control over a reporting company. *Other rights or responsibilities may also constitute substantial control. Additional information about the definition of substantial control and who qualifies as exercising substantial control can be found in the Beneficial Ownership Information Reporting Regulations at 31 CFR §1010.380(d)(1).

- “Ownership interests” generally refer to arrangements that establish ownership rights in the reporting company, including simple shares of stock as well as more complex instruments. Additional information about ownership interests, including indirect ownership, can be found in the Beneficial Ownership Information Reporting Regulations at 31 CFR §1010.380(d)(2).

- FinCEN expects that the majority of reporting companies will have a simple ownership and control structure. A few examples of how to identify beneficial owners are described below.

- Example 1: The reporting company is a limited liability company (LLC). You are the sole owner and president of the company and make important decisions for the company. No one else owns or controls ownership interests in your company or exercises substantial control over your company.

- You are a beneficial owner of the reporting company in two different ways, assuming no other facts. First, you exercise substantial control over the company because you are a senior officer of the company (the president) and because you make important decisions for the company. Second, you are also a beneficial owner because you own 25 percent or more of the reporting company’s ownership interests.

- Because no one else owns or controls ownership interests in your LLC or exercises substantial control over it, and assuming there are no other facts to consider, you are the only beneficial owner of this reporting company, and your information must be reported to FinCEN.

- Example 2: The reporting company is a corporation. The company’s total outstanding ownership interests are shares of stock. Three people (Individuals A, B, and C) own 50 percent, 40 percent, and 10 percent of the stock, respectively, and one other person (Individual D) acts as the President for the company, but does not own any stock.

- Assuming there are no other facts, Individuals A, B, and D are all beneficial owners of the company and their information must be reported. Individual C is not a beneficial owner.

- Individual A owns 50 percent of the company’s stock and therefore is a beneficial owner because they own 25 percent or more of the company’s ownership interests.

- Individual B owns 40 percent of the company’s stock and therefore is a beneficial owner because they own 25 percent or more of the company’s ownership interests.

- Individual C is not a company officer and does not directly or indirectly exercise any substantial control over the company.

- Individual C also owns 10 percent of your company’s stock, which is less than the 25 percent or greater interest needed to qualify as a beneficial owner by virtue of ownership interests. Individual C is therefore not a beneficial owner of the company.

- Individual D is president of the company and is therefore a beneficial owner. As a senior officer of the company, Individual D exercises substantial control, regardless of whether the individual owns or controls 25 percent or more of the company’s ownership interests.

- Example 3: The reporting company is a corporation owned by four individuals who each own 25 percent of the company’s ownership interests (e.g., shares of stock). Four other individuals serve as the reporting company’s CEO, CFO, COO, and general counsel, respectively, none of whom hold any of the company’s ownership interests.

- In this example, there are eight beneficial owners. All four of the individuals who each own 25 percent of the company’s ownership interests are beneficial owners of the company by virtue of their holdings in it, even if they exercise no substantial control over it. The CEO, CFO, COO, and general counsel are all senior officers and therefore exercise substantial control over the reporting company, making them beneficial owners as well.

- The term “senior officer” means any individual holding the position or exercising the authority of a president, chief financial officer, general counsel, chief executive officer, chief operating officer, or any other officer, regardless of official title, who performs a similar function. 31 CFR 1010.380(f)(8).

Will a reporting company need to report any other information in addition to information about its beneficial owners?

- Yes. The information that needs to be reported, however, depends on when the company was created or registered.

- If a reporting company is created or registered on or after January 1, 2024, the reporting company will need to report information about itself, its beneficial owners, and its company applicants.

- If a reporting company was created or registered before January 1, 2024, the reporting company only needs to provide information about itself and its beneficial owners. The reporting company does not need to provide information about its company applicants.

What information will a reporting company have to report about itself?

- A reporting company will have to report:

- Its legal name;

- Any trade names, “doing business as” (d/b/a), or “trading as” (t/a) names;

- The current street address of its principal place of business if that address is in the United States (for example, a domestic reporting company’s headquarters), or, for reporting companies whose principal place of business is outside the United States, the current address from which the company conducts business in the United States (for example, a foreign reporting company’s U.S. headquarters);

- Its jurisdiction of formation or registration; and

- Its Taxpayer Identification Number.

- A reporting company will also have to indicate the type of filing it is making (that is, whether it is filing an initial report, a correction of a prior report, or an update to a prior report).

What will a reporting company have to report about its beneficial owners and company applicants?

- For each individual who is a beneficial owner or a company applicant, a reporting company will have to report:

- The individual’s name, date of birth, and address;

- A unique identifying number from an acceptable identification document; and

- The name of the state or jurisdiction that issued the identification document.

- Address: For a beneficial owner, the reporting company must report the residential street address.

- For a company applicant, the reporting company must report the individual’s residential street address. However, if an individual engages in the business of corporate formation (e.g., as an attorney or corporate formation agent) and files the formation or registration document in the course of that business, then the reporting company must report the current street address of the company applicant’s business. For example, if the company applicant is a paralegal who filed the document while working at a law firm, the reporting company must report the business address of the law firm where the paralegal worked when filing the document.

- Identification Document: The list below sets out the forms of acceptable identification documents:

- A non-expired driver’s license issued by a U.S. state. A “U.S. state” means any state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Commonwealth of the Northern Mariana Islands, American Samoa, Guam, the U.S. Virgin Islands, and any other commonwealth, territory, or possession of the United States.

- A non-expired identification document issued by a U.S. state or local government, or Indian Tribe that is issued for the purpose of identifying the individual. For example, a non-driver identification card issued by a state Department of Motor Vehicles would qualify because it is issued for identification purposes.

- A non-expired passport issued by the U.S. government; or

- If the individual does not have any of the three forms of identification document described above, the reporting company may provide the identifying number from a non-expired passport issued by a foreign government.

- In addition, the reporting company must submit an image of the identification document associated with the unique identifying number reported to FinCEN.

How will I report my company’s beneficial ownership information?

CTA Filing Solutions handles it. Our team will reach out to you before the filing due date to confirm there has been no change in information and confirm we are able to proceed with filing the information the client disclosed.

Who will be able to access reported beneficial ownership information and for what purposes?

- The Corporate Transparency Act authorizes FinCEN to disclose beneficial ownership information in certain circumstances to six types of requesters:

- U.S. Federal agencies engaged in national security, intelligence, and law enforcement activities;

- State, local, and Tribal law enforcement agencies with court authorization;

- The U.S. Department of the Treasury;

- Financial institutions using beneficial ownership information to conduct legally required customer due diligence, provided the financial institutions have their customer consent to retrieve the information;

- Federal and state regulators assessing financial institutions for compliance with legally required customer due diligence obligations; and

- Foreign law enforcement agencies and certain other foreign authorities who submit qualifying requests for the information through a U.S. Federal agency.

- The Corporate Transparency Act imposes stringent access requirements and safeguards on each group of requesters.

How will FinCEN protect beneficial ownership information reported to it?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam tempor arcu non commodo elementum.

- Protecting the security and confidentiality of beneficial ownership information is a top priority for FinCEN. Federal law requires FinCEN to implement protocols to safeguard beneficial ownership information, to build a secure IT system to store the information, and to establish processes and procedures to ensure that only authorized users can access beneficial ownership information for authorized purposes.

- FinCEN is developing the policies and procedures that will govern access to and handling of beneficial ownership information. FinCEN is also building a secure and confidential IT system to store the information. Consistent with Federal law, the system will be cloud-based, and will meet the highest Federal Information Security Modernization Act (FISMA) level to keep beneficial ownership information secure.

- FinCEN will work closely with those authorized to access beneficial ownership information to ensure that they understand their roles and responsibilities to ensure that the reported information is used only for authorized purposes and handled in a way that protects its security and confidentiality.